what cities qualify for usda loan

The borrowers income must be within 115. First the property in question must.

What Is A Usda Loan Pacres Mortgage

Rural areas must fall into one of the three following categories.

. This number compares your monthly income to your. Also the home to be purchased must be located in an eligible rural area as defined by USDA. Heres what you need.

It must have no more than 10000 residents. USDA eligibility for a 1-4 member household requires annual household income to not exceed 91900 in most areas of the country and annual household income for a 5-8. The borrower must be either a US.

Using a USDA loan eligibility map is a relatively simple process. A locked padlock or https means youve safely connected to the gov website. In order to be eligible for many USDA loans household income must meet certain guidelines.

The programs also make funding. It must meet all. With the passage of the Farm Bill areas with populations up to 35000 that are rural in character are eligible for USDA Rural Development housing programs with the following provisions.

To qualify for purchase with a direct loan from the USDA a property has to meet the following requirements. How To Use USDA Loan Eligibility Maps In Your Area. The property must be in an eligible area.

USDA home loans are zero down payment mortgages for eligible rural development zones backed by the US. Citizen or a permanent resident. USDA loans are low-interest mortgages with zero down payments designed for low-income Americans who dont have good enough credit to qualify for traditional mortgages.

Then you need to calculate your debt-to-income ratio. Minnesota USDA Home Loan eligibility will be determined by your financial history and the property youre choosing to buy. Share sensitive information only on official secure websites.

USDA provides homeownership opportunities to low- and moderate-income rural Americans through several loan grant and loan guarantee programs. Charley Farley Home Loans Office 603 471-9300 Fax 855 812-9282 650 Elm St Suite 600 Manchester NH 03101. The program means to help low-income individuals and.

To start go to the USDAs interactive map and. To get a USDA loan youll typically need a credit score of 640 or higher. The CalHFA USDA Program is a USDA Guaranteed first mortgage loan program which can be combined with the MyHome Assistance Program MyHomeThe MyHome and School.

Simply stated a USDA loan is a loan provided by the United States Department of Agriculture to expand upon rural development. If the area has 10001 to 20000 residents it cannot be located in an MSA. NextAdvisor offers a quick overview of these requirements.

Search for usda eligible homes for sale near you and qualify for a ZERO down USDA home loan. Find USDA Eligible properties in nearby cities.

Georgia Contacts Rural Development

Waynesboro City Virginia Usda Eligibility

Usda Rural Housing Loan In Wisconsin

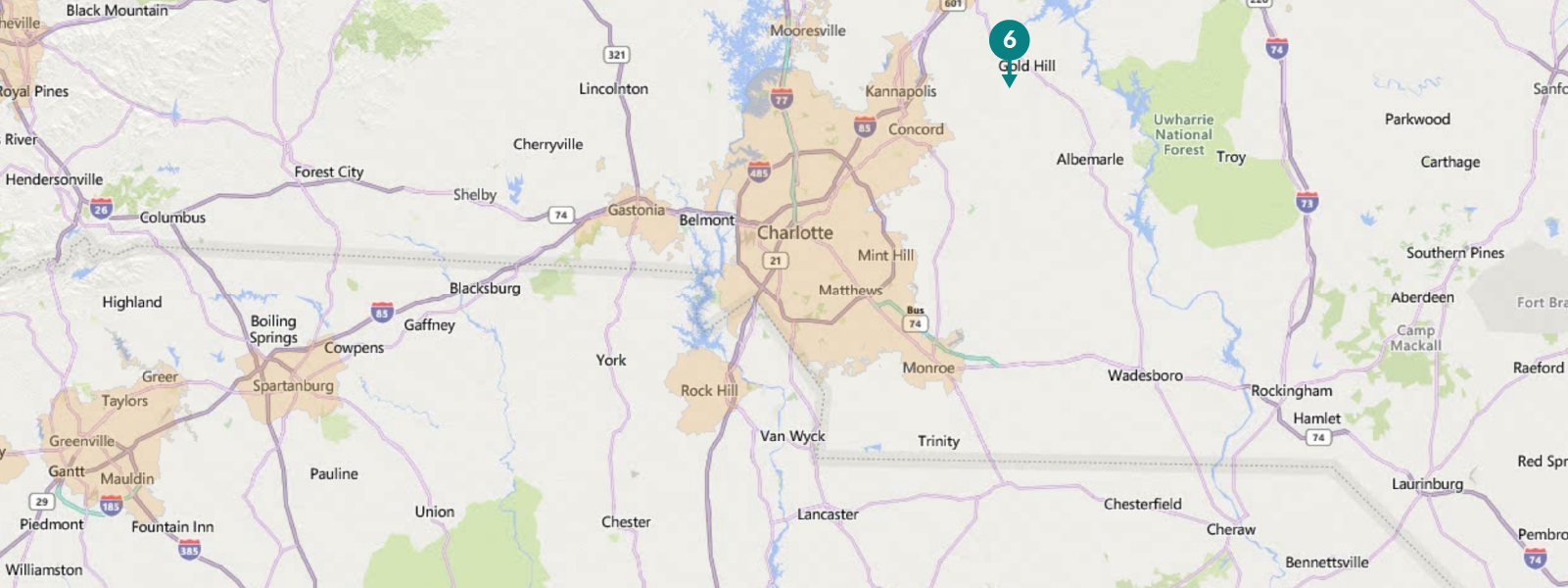

Usda Loans Charlotte Nc The Usda Home Loan Maps For Charlotte Nc

Usda Eligibility Maps How To Use In Your House Hunt

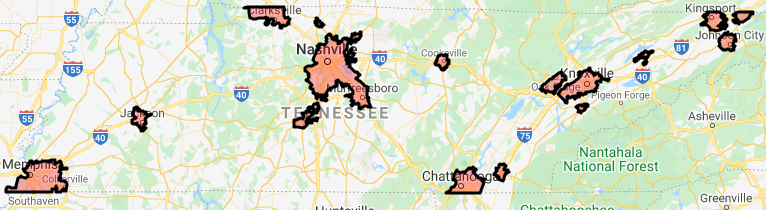

Regions Of Tennessee That Are Eligible For Usda Backed Home Loans

Kentucky Usda Rural Housing Mortgage Lender Kentucky Usda Rural Development Property Eligibility For Frankfort Fort Thomas Winchester Richmond Radcliff Fort Campbell And Hopkinsville Ky Cities

How Do Usda Loans Work Primelending Kansas City

Usda Rural Housing Loan Usda Loan Eligibility Map Ccmc

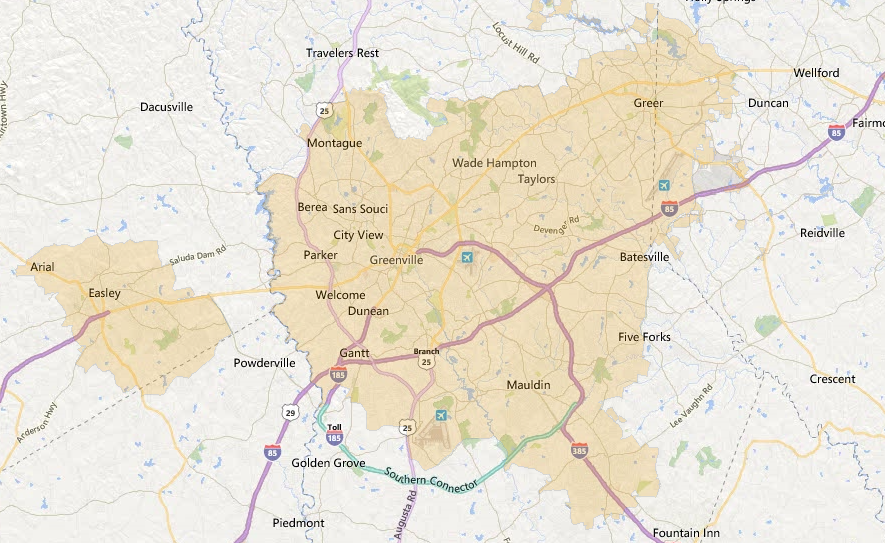

Usda Loans Greenville Sc How To Find Usda Eligible Homes Greenville County

Usda Loans Arizona Arizona Down Payment Assistance

Usda Loans In Marion County Usda Loan Pro

Canon City Usda Mortgage Loan Trust Home Loans Llc

Usda Rolls Out New Rural Development Loan Opportunities For Sand Springs Area Sandite Pride News

The Pros And Cons Of Usda Loans Primelending Twin Cities

Usda Home Loans Rural Development Loan Property Mortgage Eligibility Requirements

/USDA-f15c17eea4cb4a169441b96f5c15b6e7.jpg)